Dong Van 1 industrial zone

Dong Van 1 industrial zone is located in Dong Van town, Duy Tien district, Ha Nam province, next to National Road No 1A, the North-South high way, National Road No 38 and the North-South railway...

Dong Van 1 industrial zone

Investor: Investment & Construction Management Board in industrial zone in Ha Nam

Address: No 209 Le Hoan, Phu Ly, Ha Nam

- Location:

+ Dong Van town, Duy Tien district, Ha Nam province.

+ Next to National Road No 1A, the North-South high way, National Road No 38 and the North-South railway.

+ 40 km far from the centre of Hanoi city

+ 70 km far from Noi Bai Airport

+ 90 km far from Hai Phong Seaport.

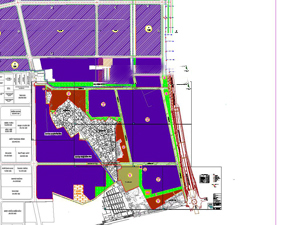

Model of Dong Van 1 industrial zone

- Area: 208 ha.

Dong Van 1 industrial zone

The infrastructure construction for the first phase with 138 ha has been completed. There are 59 companies investing into this industrial zones with the investment capital of 2274 billion VND and 94.1 million USD among which there are 20 foreign companies coming from different countries such as Korea, Singapore, Twain, China. At the moment, there is 50 ha of unoccupied land for investors.

Dong Van 1 for expansion: 71 hectares

Land rental included infrastructure: 50-55USD/sqm/50 years (depending on location of each land plot)

Cost for industrial services and infrastructure maintenance: 0,3USD/sqm/year

Price of electricity and water: as price regulated by State

Labor Cost:

+ Workers: about 3 million VND/person/month

+ Professional and technical employees: 4-5 million VND/person/month

Wastewater treatment: Enterprises must treat wastewater to meet B standard before discharging into the centralized wastewater treatment plant of industrial zones which treats wastewater to meet A standard (waste water treatment charge: 8,000 VND/m3). If Enterprises treat their wastewater to meet A standard, they don’t need to pay for wastewater treatment.

Telecommunication: Telecommunication system is provided to the business’s fence by two great telecommunication groups of VNPT and Viettel. Price is regulated by these groups.

Some Incentives

- Incentives on export – import tax for commodities are applied according to Export – Import Law No 45/2005/QH11 dated 14th June 2005 and Decree No 87/2010/ND-CP dated 13thAugust 2010 of the Government regulating in detail to implement the export and import law.

- Incentives on corporate income tax are applied according to Decree No 24/2008/ND-CP dated 11th December 2008 regulating in detail to implement the Corporate Income Tax Law and Decree No 122/2011/ND-CP dated 27 December 2011 amending and supplementing some articles of Decree No 124/2008/ND-CP dated 11th December 2008 of the Government.

- Incentives on land rental are applied according to Decree No 142/2005/ND-CP dated 14thNovember 2005 and Decree No 121/2010/ND-CP dated 30th December 2010 of the Government on collecting land rent and surface rent (exemption from land rent in 02 years for construction schedule, and 03 years since the date of operation)

- Receive supporting fee for local employee training with 300,000 VND/person if employing 50 workers and more.

(izhanam)